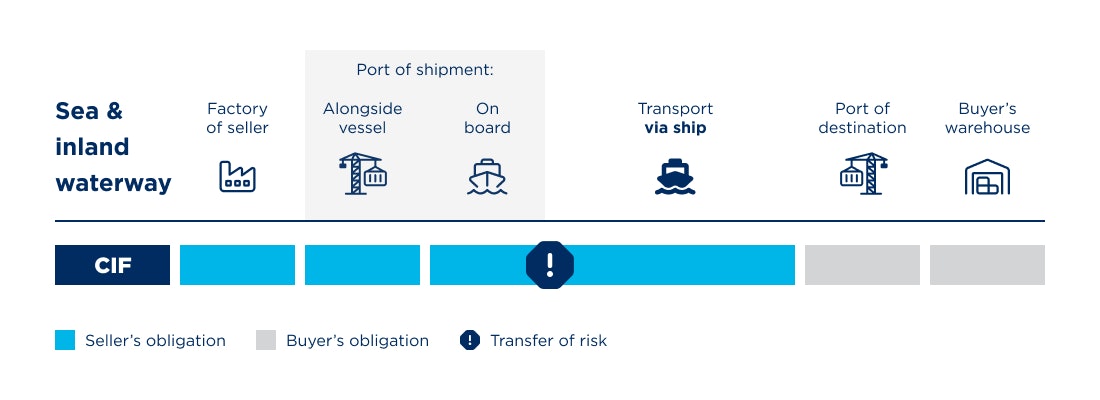

As with all Incoterms in the C-group, this is a two-point clause: The risks are already transferred to the buyer upon delivery or procurement of the delivered goods. However, in the case of CIF, the seller is obliged to take out insurance that meets the minimum standard (clause C of the Institute Cargo Clauses or comparable).

While the insurance coverage for Incoterm CIP has been changed to the highest level "All Risks" (ICC A) under Incoterms 2020, the standard required insurance under CIF 2020 has remained at clause C. The scope of insurance can be adjusted by mutual agreement.

CIF Delivery Terms: What is there to consider?

As already mentioned, the goods must either be loaded on board by the seller or they procure goods that are ready for shipment. This works very well with general cargo or bulk goods (ore, oil, etc.). Certain goods - especially containers - are usually not brought on board by the seller themselves but delivered to the terminal responsible for the next steps.

As a result, the seller is not able to fulfil the requirement of Incoterm CIF at all, and in the often critical transition from terminal to loading, the risk remains with the seller. It is better to use Incoterms such as CIP here.

Otherwise, the seller must provide the buyer with the necessary transport documents such as a bill of lading. These must enable the buyer to claim the goods from the carrier at the port of destination or enable the sale while the goods are still in transit.

CIF Port of Destination: Arrange exact location and costs

It is advisable to specify the exact point up to which the seller bears the costs at the CIF port of destination. After after the arrival of the goods there are still various stations and associated services - of course with corresponding costs. Potential disputes should be eliminated by clarifying exactly who pays what from when (from unloading costs to lighterage costs to quay dues). As a rule, it should be specified in the contract of carriage who bears the unloading costs. If this is not specified, the seller is responsible for unloading.

CIF: Cost, insurance and freight price

The seller shall take care of suitably packaging the goods for transport if required. Before loading, the seller organises and pays for the necessary "pre-shipment inspections". For import and transit - if applicable - the buyer is responsible for this. Both buyer and seller must provide the other side of the contract with the necessary information and documents required for import, export and transit, or even for taking out insurance. Whoever is responsible for a task always also bears the costs for the procurement of the documents by the contracting party.

CIF insurance coverage: Problems and possibilities

As mentioned before, in contrast to the Incoterm CIP, the insurance level was left at the lowest level (ICC clause C: cover for a selection of explicitly named risks, sum insured 110% of the goods sales value in the contract). This low insurance level (with correspondingly favourable conditions) makes sense insofar as transports via CIF tend to involve smaller tangible assets that are at the same time less susceptible to damage (such as bulk goods like coal).

Nevertheless, the buyer can want a higher level of insurance protection (for example against the consequences of war or strikes). Goods that are more susceptible to damage or are more "attractive" stolen goods also make better protection sensible. In this case, the buyer must bear the additional costs. Of course, insurance cover deviating from the standard can be agreed in advance - after all, all Incoterms are in principle adaptable by mutual agreement!

The insurance must be taken out with a reputable provider. The coverage extends to the agreed destination. It may happen that the choice of insurance company is prescribed by the buyer. The buyer may also impose firm specifications on the choice of shipping company - all against the background that Incoterms can be adapted as required.

Incoterm CIF or FOB: Which is better?

CIF transport terms and FOB (Free on Board) are almost identical, the difference being that with CIF the seller bears the transport costs to the port of destination and also takes out insurance. At first glance, therefore, CIF seems to be more attractive for the buyer, as they save transport costs and insurance. Nevertheless, FOB has some advantages: As the buyer chooses the shipping company or the forwarder, they have a corresponding influence on the quality and speed of the transport.

CIF Freight Charges: The hidden costs

Cost factors such as customs agents are often hidden in supposedly favourable CIF transport terms. Chinese and increasingly also Latin American sellers like to use these means. The customs agent is not part of the transport costs, but later shares a much higher fee with the seller. Furthermore, the notifying forwarder on behalf of the seller can suddenly demand fees such as "China Import Service Fees" (CISF) or a "Destination Exchange Rate Surcharge" (and much more) and refuse to deliver the goods if they are not paid. Regardless of the legality of these items, it can be difficult to legally defend against them. Here, too, it may therefore make sense to choose FOB as a preventive measure, as this clause also mandates the notifying carrier. This allows for better cost control.